21 Javascript Federal Income Tax Calculator

37%. Based on the tax rates in the table above, the maximum marginal tax rate for a single filer with income of $50,000 is 22%. However, the taxpayer will not pay that rate for all $50,000. The first $9,875 of taxable income would be taxed at 10%, the next $30,250 would be taxed at 12%, and then the last $9,875 would be taxed at 22%. Get started for free. These calculations are approximate and include the following non-refundable tax credits: the basic personal tax amount, CPP/QPP, QPIP and EI premiums, and the Canada employment amount. After-tax income is your total income net of federal tax, provincial tax, and payroll tax. Rates are up to date as of June 22, 2021.

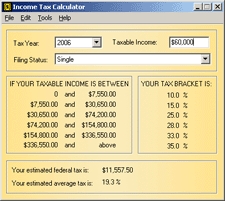

Income Tax Calculator Standaloneinstaller Com

Income Tax Calculator Standaloneinstaller Com

Deductions lower your taxable income by the percentage of your highest federal income tax bracket. For example, if you fall into the 25% tax bracket, a $1,000 deduction saves you $250.

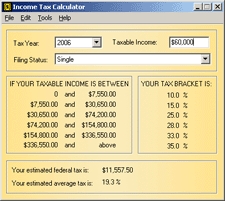

Javascript federal income tax calculator. The Income Tax Department NEVER asks for your PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts through e-mail.. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card, bank and other financial accounts. Dare to Compare Now. Estimate your 2021 Paycheck Tax Withholding. P1 Select Your Filing Status. Step 1c of the W-4. Single Head of Household Married Filing Jointly Married Filing Separately Qualifying Widow (er) P2 How Often Do You Get Paid. W-4 Worksheet. Weekly Every Other Week Twice a Month Monthly Daily. Income Tax Calculator using JavaScript . 100 | 0 | Tweet | Facebook | linkedin | Connect | Live Chat | viewed {4387} Published on, 08 Apr 2018. i am going to give you a simple example. copy the code and paste it on your work environment. and please fill the value as your requerment and its work as you want. ...

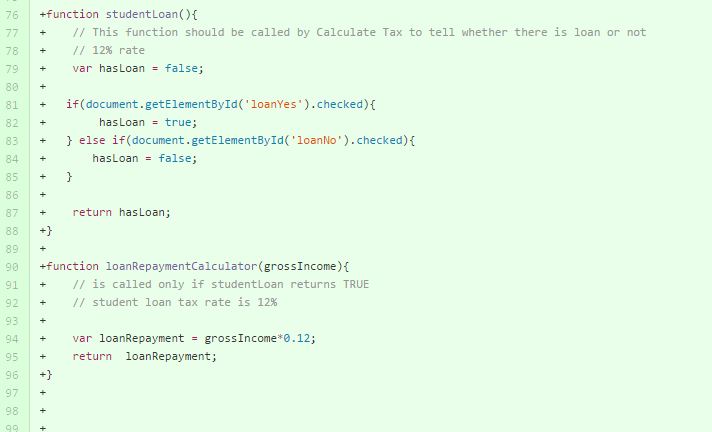

Calculator Use. Estimate your US federal income tax for 2020, 2019, 2018, 2017, 2016, 2015 or 2014 using IRS formulas. The calculator will calculate tax on your taxable income only. Does not include income credits or additional taxes. Does not include self-employment tax for the self-employed. Also calculated is your net income, the amount you ... 17/6/2018 · A JavaScript built Income Tax Calculator giving full tax breakdown information dependant on salary and tax bands. (demo available) - ay437/Tax-Calculator-JavaScript That's where our paycheck calculator comes in. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

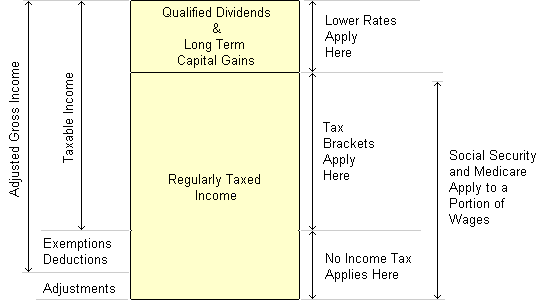

This calculator computes federal income taxes, state income taxes, social security taxes, medicare taxes, self-employment tax, capital gains tax, and the net investment tax. The provided information does not constitute financial, tax, or legal advice. We strive to make the calculator perfectly accurate. US Federal Income Tax calculator in javascript. GitHub Gist: instantly share code, notes, and snippets. Suppose the federal tax table is as follows and you are asked to calculate the tax of an employee whose salary is $ 30,000. So to calculate the federal income tax, we will tax her up to to 15%, which is where her income gap lies. Therefore for the first 15,000, we will tax her 10%.

1040 Tax Estimation Calculator for 2019 Taxes. Enter your filing status, income, deductions and credits and we will estimate your total taxes. Based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe the IRS next April. Please note this calculator is for the 2019 tax year which is due in 2020. Free online income tax calculator to estimate U.S federal tax refund or owed amount for both salary earners and independent contractors. It can also be used to estimate income tax for the coming year for 1040-ES filing, planning ahead, or comparison. Explore many more calculators on tax, finance, math, fitness, health, and more. Extra 4-3 Develop the Income Tax Calculator. In this exercise, you'll use nested if statements and arithmetic expressions to calculate the federal income tax that is owed for a taxable income amount. This is the 2017 table for the federal income tax on individuals that you should use for calculating the tax: Open the HTML and JavaScript files ...

Use our income tax calculator to help forecast your federal income taxes before you file. Just enter your income and some details about your personal situation to get an idea of your tax situation. Javascript is required for this calculator. As of 2016, there are a total of seven tax brackets. The current tax rates (2017) consist of 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. Updated January 2018: The new 2018 tax brackets are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Use our Salary Tax Calculator to get a full breakdown of your federal and state tax burden given your annual income and ... Federal Tax Withholding Calculator. Remember: this is a projection based on information you provide. This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. Occupational Disability and Occupational Death Benefits are non-taxable.

Answered by otengkwaku 30 in a post from 7 Years Ago. You have create the calcTaxes but you are not calling it. i think you should do it like this: var calculate_tax = function() { var total; var income = parseFloat( $("income").value ); $("tax").value = calcTaxes(income); console.log(tax); function calcTaxes(amount){ var calculate = 0; if ... The Tax-Rates Tax Calculator is now fully updated! Federal calculations will now use the official federal tax brackets and deductions, and state calculations will use the most recent brackets available. There have been several major tax law changes as of tax year 2013, including several that are the result of new Obamacare-related taxes. 12/5/2019 · Java Program - Income Tax Calculator. 12th May, 2019; 14:07 PM; Challenge - Java Program - Income Tax Calculator . Program - import java.util.*; /** * @author thanhtanpc@gmail * */ public class TaxCalculator { private static int income; private static int deduction; private static String status; /** * @param args */ public static void main ...

Simple Federal Tax Calculator (Tax Year 2017) Get a Simple Federal Tax Calculator (Tax Year 2017) branded for your website! Colorful, interactive, simply The Best Financial Calculators! Enter your filing status, income, deductions and credits and we will estimate your total taxes. Based on your projected tax withholding for the year, we can ... Tax Plan Calculator. We've created a tax calculator that helps demonstrate how the Tax Cuts and Jobs Act (TCJA) and other major tax reform proposals could affect taxpayers in different scenarios. The calculator allows you to compare how different sample taxpayers fare under different proposals. Federal Tax Calculator The Federal Tax Calculator is an easy tool that anyone who wants to know the amount of their federal tax return. You go to the site and input your filing status. You input your exemptions, income, payments, and credits. Once that is done, submit it, and the software will calculate an estimate of your federal tax return.

2021 Self Employment Tax Calculator. The goal of the self-employment tax calculator is to give those who are entering the freelance economy a rough estimate of the maximum amount they may owe in taxes. The calculator is most useful for those who have a grasp of what their net taxable income will be. 1/1/2021 · Sales Tax $1,433. Fuel Tax $150. Property Tax $5,341. Total Estimated Tax Burden $19,560. Percent of income to taxes = 35%. $19,560. Created with Highcharts 6.0.7. About This Answer. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of ... 1040 Tax Calculator (Tax Year 2014) Get a 1040 Tax Calculator (Tax Year 2014) branded for your website! Colorful, interactive, simply The Best Financial Calculators! Enter your filing status, income, deductions and credits and we will estimate your total taxes. Based on your projected tax withholding for the year, we can also estimate your tax ...

15/10/2015 · Javascript Income tax calculator. 0. Tax Calculator in C# - How to Display debt over time. 0. I cannot calculate a tax function in a salary tax calculator. 0. i'm trying to create an income tax calculator but i've been stuck on the state tax section. Hot Network Questions Attention: This Tax Return Calculator is for Tax Year 2021 (January 1 - December 31, 2021) and uses the latest information provided by the IRS. As new information is released, we will update this page. Update March 15, 2021: The American Rescue Plan was signed into law on March 11, 2021. Because of this, there will be some changes to the 2021 Tax Calculator below. Calculate the adjusted wages. First, use the worksheet found on page 5 of IRS Pub 15-T to calculate the adjusted annual wage amount. Figure the tentative tax to withhold. Once you have the adjusted annual wages, you can use the tax table found on page 6 of IRS Pub 15-T and calculate the annual federal income tax amount. Account for dependent ...

17/12/2012 · i try to make it like this but i dont know how to get the salary and the name and taxrate put it in the comment or notes place may any body help ? the program should get the name and taxrate and salary and print it inside the textarea using javascript when i click on calculate … This Tax Withholding Estimator works for most taxpayers. People with more complex tax situations should use the instructions in Publication 505, Tax Withholding and Estimated Tax. This includes taxpayers who owe alternative minimum tax or certain other taxes, and people with long-term capital gains or qualified dividends. 1040 Income Tax Calculator. When it comes to your taxes, it's best to have some idea where you stand before meeting with your Tax Pro. Use this 1040 Income Tax Calculator to estimate your tax bill or refund. If you owe, you have more time to gather the money. If you get a refund you can plan how you will use the funds.

Welcome to the new Tax-Rates Income Tax Calculator! We're proud to provide one of the most comprehensive free online tax calculators to our users. You can use this tax calculator to: estimate your federal and state income taxes. calculate your expected refund or amount of owed tax. check your eligibility for a variety of tax credits.

Javascript Project Ird Tax Calculator Gil S Learning Journey

Javascript Project Ird Tax Calculator Gil S Learning Journey

4 Add The Javascript Event Handler For The Click Event Of The

4 Add The Javascript Event Handler For The Click Event Of The

Taxtips Ca Basic Canadian Income Tax Calculator For 2021

Taxtips Ca Basic Canadian Income Tax Calculator For 2021

Simple Tax Refund Calculator Find Out How Much You Ll Get

Simple Tax Refund Calculator Find Out How Much You Ll Get

Github Shaneswezey Tax Calc React Js Federal Income Tax

Tax Calculator Github Topics Github

Us Federal Income Tax Calculator

Us Federal Income Tax Calculator

Federal Income Tax Calculator 2020 Credit Karma

Federal Income Tax Calculator 2020 Credit Karma

Build A Dynamic Income Tax Calculator Part 1 Of 2

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Github Ay437 Tax Calculator Javascript A Javascript Built

Tax Calculator Github Topics Github

Dynamic Sales Tax Calculator In Jquery Edit Price Helper

Dynamic Sales Tax Calculator In Jquery Edit Price Helper

What S The Average American S Tax Rate The Motley Fool

What S The Average American S Tax Rate The Motley Fool

Excel Formula Basic Tax Rate Calculation With Vlookup

Excel Formula Basic Tax Rate Calculation With Vlookup

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Here Are Your New Income Tax Brackets For 2019

Here Are Your New Income Tax Brackets For 2019

0 Response to "21 Javascript Federal Income Tax Calculator"

Post a Comment